It is challenging to find good companies these days. What if I told you you could invest in as many as 30 companies in investing in just one company? Sounds confused?. Then you are among the many who first has the same reaction. But it is true; you can invest in one good company and have portions of many listed and unlisted companies. These are excellent and well-known companies having investments in many other companies. Some time the valuation of the parent company is far less than the actual book value. Some of the companies are just holding companies, and a few others are good companies strategically invested in other companies and subsidiaries as they have grown to the behemoth today. Let’s discuss a few of such companies today,

The number one in this list is a Tata group company

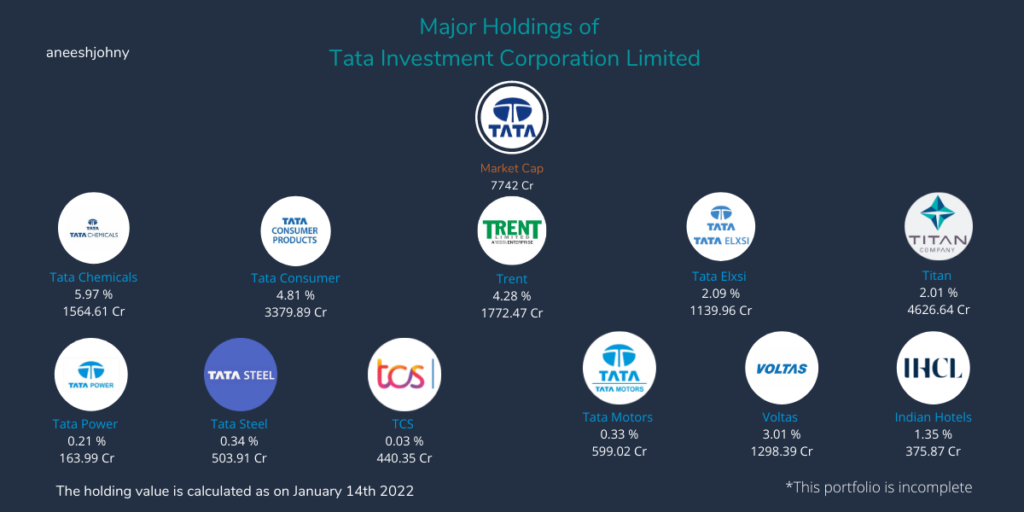

1. Tata Investment Corporation Limited (TICL)

This is an NBFC company under the Tata group and listed in NSE and BSE. The company was incorporated in 1937 as The Investment Corporation of India until its listing in 1959 in BSE. Currently, the company invested in more than 70 companies, including Tata group companies. As of January 14th, 2022, the market capitalization of TICL is ₹7742 Cr and the total investment values in Tata Group listed companies are valued more than ₹15000 Cr. This value excludes investments in other listed companies such as Infosys, Mahindra and Mahindra, and other unlisted companies.

2. Housing Development Financial Corporation (HDFC)

HDFC is one of the stable financial companies in the country and operates in the regime of housing finance. One of the largest housing and property financiers in India. The company has banking, insurance, asset management, and technology spaces investments. HDFC holds about 21% of the largest private bank equity shares in India, HDFC Bank, through its various subsidiaries. HDFC is also the promoter of HDFC Life and HDFC AMC, holding 49.9% and 52.7%. HDFC has two more unlisted subsidiaries, HDFC Ergo (in health insurance) and HDFC Credila (in education loan); they plan to list them in coming years. In the last year alone, the share price of HDFC rallied more than 50% and can expect to move up further due to the post-pandemic revival of the economy. HDFC Bank also has many unlisted subsidiaries, which eventually add value to HDFC.

3. Bajaj Holdings and Investments (BHIL)

Bajaj Holdings and Investments limited was formed by de-merging Bajaj Auto in 2007. BHIL is an NBFC company operating in the Indian financial space. The manufacturing arm of the Bajaj conglomerate was transferred to the newly formed Bajaj Auto, and the wind energy and financial business transferred to BHIL. Both the financial (Bajaj Fin Serve) and manufacturing arms are doing very well and are leaders in their respective industries.

BHIL holds 33.43% stakes in Bajaj Auto and 39.16 % stakes in Bajaj Fin Serve. Bajaj Fin Serve also hold stakes in Bajaj Allianz General Insurance, Bajaj Finance and Bajaj Financial Solutions. As of January 14th, 2022, the total holding value of BHIL is over Rs: 200,000 Cr.

4. ICICI Bank

ICICI Bank is one of the largest private banks in India and has operations in nook and corner of the country. It was incorporated in 1955 as a joint venture subsidiary between the World Bank and a consortium of Indian banks and insurance companies. As of October 14th, 2021, the market capitalization of ICICI bank stands more than Rs: 500,000 Cr. ICICI has four main subsidiaries, among other investments, and three of them are listed companies. ICICI Bank holds 48.08 % stakes in ICICI Lombard, 74.91 % stakes in ICICI securities, and 51.34 % stakes in ICICI Prudential Life Insurance. ICICI bank has two more unlisted subsidiaries called ICICI Direct and ICICI Prudential AMC. The total holding valued more than Rs: 120,000 Cr.

5. Larsen and Toubro (LT)

Larsen and Toubro is a multinational conglomerate and India’s largest engineering, procurement, and construction (EPC) company. Incorporated in 1938 in Bombay, L&T emerged as the largest contractor in India, literally building India from independence. L&T has entered into real estate, technology, engineering, construction, finance, heavy engineering, and manufacturing. L&T formed many subsidiaries in different sectors and out of which 4 of them are listed companies. L&T holds 73.93 % in L&T Technology Services, 74.07 % in L&T infotech, and 63.50 % in L&T financial holdings. Recently L&T accused majority stakes in IT service company Mindtree (61%), and since then, the stock price increased 500% and is expected to grow more due to post covid economic revival. The price of L&T shares increased more than 200%, beating the index.

This list is not complete; many other listed companies have holdings in other companies. Some honorable mentions are Adithya Birla Group, RPG group, and more. We only mention the major holdings of these listed companies; the full portfolio of these companies consists much more subsidiaries and holdings.

Advantages of Investing in companies with stock portfolios

The companies with a diversified stock portfolio usually sell at a discount for many reasons, one of which is the performance of some subsidiaries. The poor performance of some of the subsidiaries may drag the valuation of the parent company. The parent company holds a significantly high percentage of stocks in the listed subsidiaries, which limits the availability of such stocks and may increase the company’s valuation. But as with every stock in the market, due diligence and thorough research are required before deciding on investing in these stocks.