The stock market is where some people create wealth, and most of us lose wealth. These are the stories of people who started from nothing and built a fortune from the stock market alone with sheer persistence and patience.

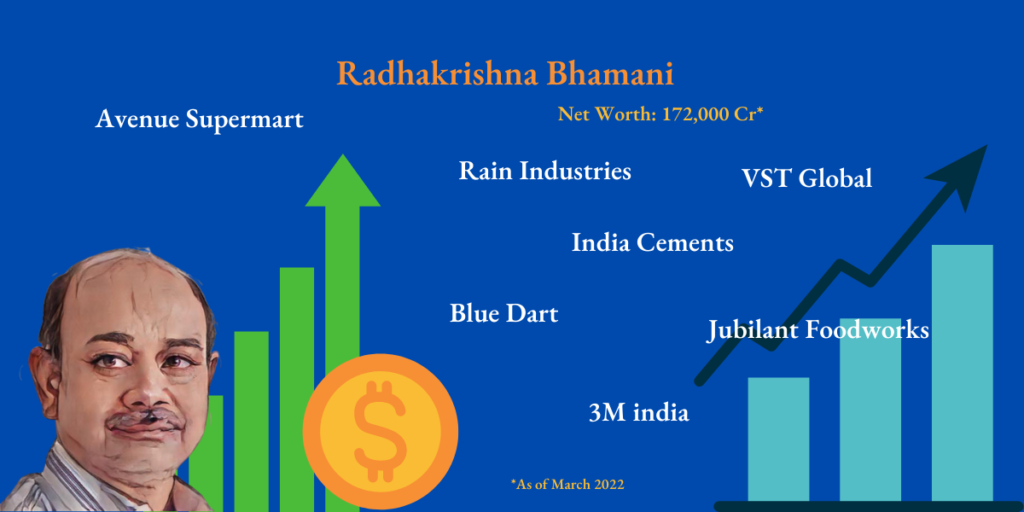

Radhakrishna Dhamani

Let’s start with Mr. Radhakrishna Dhamani. A billionaire four times wealthier than Rakesh Jhunjhunwala but less known. He owns Avenue supermarkets, the D-mart supermarket chain holding company, one of India’s prominent retailers. After his father’s death, a college dropout, he moved into his father’s stock market business. He made a lot of profits during the Harshad Mehta scam, and he is reportedly the largest individual shareholder in HDFC Bank. The majority of his net worth is from Avenue supermart. He holds more than 20 companies in his portfolio.

Rakesh Jhunjhunwala

The foreknown name in stock market hero in India is Rakesh Jhunjhunwala. There is no need to introduce him, his style of practice, or his company Rare Enterprise. He started his stock market career with an investment of Rs: 5000 and turned it to a whopping 40000 Cr. His significant investment is in Titan, a luxury goods and watches company, and he has been holding it for the past 20 years. He bought Titan at Rs: 2 per share, and the current valuation of the share is at Rs: 2000. He also invested in many privately held companies, and he recently started a budget airline called akasha. His portfolio has more than 25 companies.

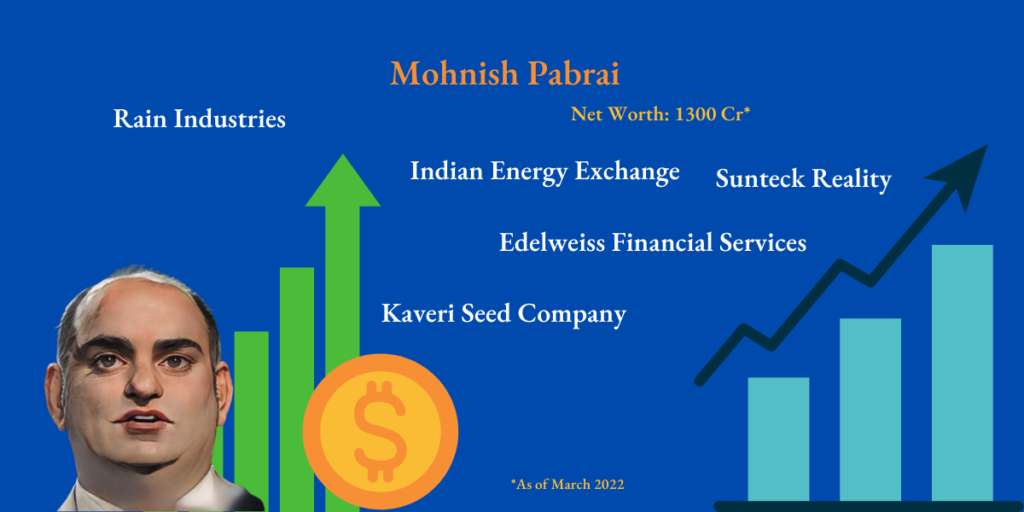

Mohnish Pabrai

Inspired by Warren Buffet and his investment style, an Indian-American investor created a portfolio worth 1500 Cr. He started as a software engineer and later started his own IT service company. Later, he sold his company, took the money from the sale, and started his Hedge fund called Pabrai Investment Fund. He turned his small savings into $600 mn assets. He holds significant shares in Edelweiss Financial Services, Rain industries, and sundeck reality.

Vijay Kedia

Vijay Kishanlal Kedia is an investor from Kolkata, and he has been an active stock market participant through his teen ages. He owns Kedia Securities put ltd. He holds larger shareholdings in many companies. His investment philosophy is strictly based on the SMILE principle, which translates into Small in size, Medium in experience, Large in aspiration, and Extra large in market potential. He has a net worth of more than 500 Cr. His investment includes Vaibhav Global, Ramco systems, Heritage foods, etc.

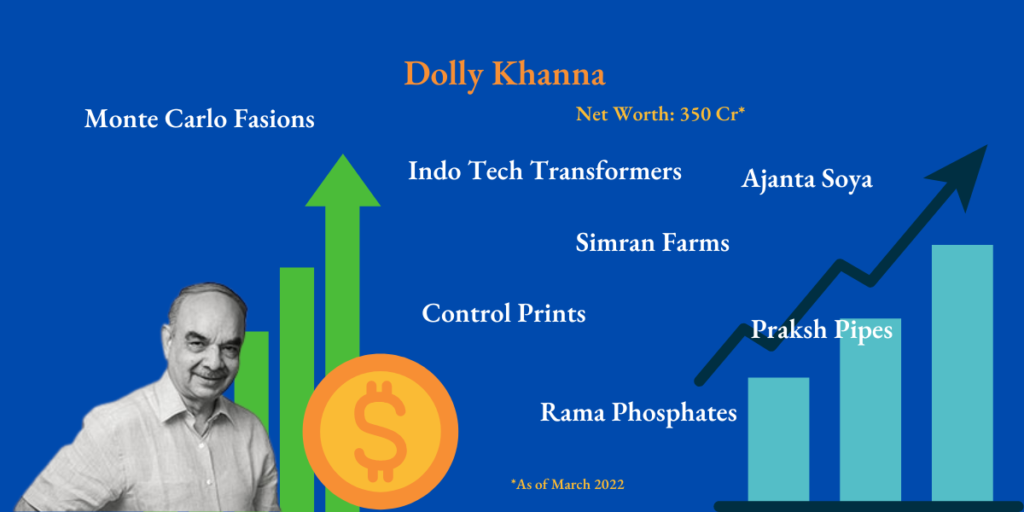

Dolly Khanna

Dolly Khanna is a Chennai-based investor famous for picking the least known gems in the stock market. She has been active in the share market since 1996, and her portfolio is managed by her husband, Rajiv Khanna. Her net worth is over 350 Cr, and she has a portfolio of 20 companies. The newest addition to her portfolio is Praksh Pipes, Tinna Rubber, Rama phos[ate New Delhi Television Rain industries, etc.

Porinju Veliyath

Porinju Veliyath is a Malayali investor and hedge fund manager who manages funds through his security firm equity intelligence India private limited. He is known for creating wealth from nothing. He started as a telephone operator in Ernakulam and later moved to Bombay( now Mumbai) to work in Kotak Securities. He is famous for his value investing style and actively participates in social media. HE held positions in many director boards of prominent companies.

Conclusion

These heroes started with little or nothing and became the richest by sheer persistence, hard work, and patience. The stock market is volatile for the short term, but it will consistently outperform other asset classes for a long time. Like the COVID pandemic and War, be prepared and build your portfolio and create wealth in these extreme situations.