The title seems a little odd, but this is the story of a well-known investor. You know him, but let’s go into some details first before revealing his name. This boy, born in the midst of the great depression, into a poor family, on August 30th, 1930, in Omaha, Nebraska, USA. His father was a stockbroker and lost his job, and his mother was a house maker. During the Great Depression, his family lost all their savings due to the bank’s failure. During his childhood, he watched his mother skip dinners to serve food for other family members. This situation makes him realize the value of money. They even skip going to church because they can not afford to pay the mandatory church contribution. This situation makes him take a wow to make his first million at the age of 35, and if he cannot, he will throw him out from the tallest building in Omaha. In reality, he made his first million at the age of 37. And yes, you guessed it correct, this is the story of none other than Warren Edward Buffett, the stock market genius, Oracle of Omaha.

The oracle of Omaha: Warren Edward Buffet. (Picture is taken from exame.com)

Early childhood

He showed extreme talent in mathematics and numbers from an early age and was interested in patterns. One day he saw a discarded soda cap near a wending machine and was curious to take some observation. He started to collect the bottle cap, and he collected them for an entire week and identified the best-selling soda and flavors. This interest grew as little Warren grew up and started exploring companies’ financials and the stock market from his father’s newspapers. His thirst for the stock market started at 11 when he visited the New York Stock Exchange.

He bought the stocks of Cities Services, a utility company at that time, for him and another three for his sister. He sold the share at a profit, but the stock price went up 100% in a matter of weeks after he sold the share. This made little Warren think about the chances and opportunities in the stock market.

In his early school days, he started small business ventures, which turned out to be successful and made him a handful of money by the time he graduated from college. At 15, he earned more than $100 per month delivering newspapers and a successful pinball machine business with his close friend. Later he graduated from the University of Pennsylvania with a Bachelor of Science in Business Administration and then enrolled in Columbia Business School for his Masters in Economics. His teacher and mentor, Benjamin Graham, was a professor there, which shaped his investment decision.

Business Career

He started working at Buffett-Falk & Co. as a salesman in 1951 and later moved to Graham-Newman Corp in 1954. He started his partnership, Buffett Partnership LLC as a general partner in 1956. He started seven new partnerships and met his future partner, Charlie Munger, a war veteran and investor. He then asked one of his partners, a doctor by profession, to find him ten more doctors who could invest $10,000 each in his partnership. He can find 11 such partners and invested only $100 from his pocket. With the capital pooled from new partners, he can make a return of more than 50% in two years.

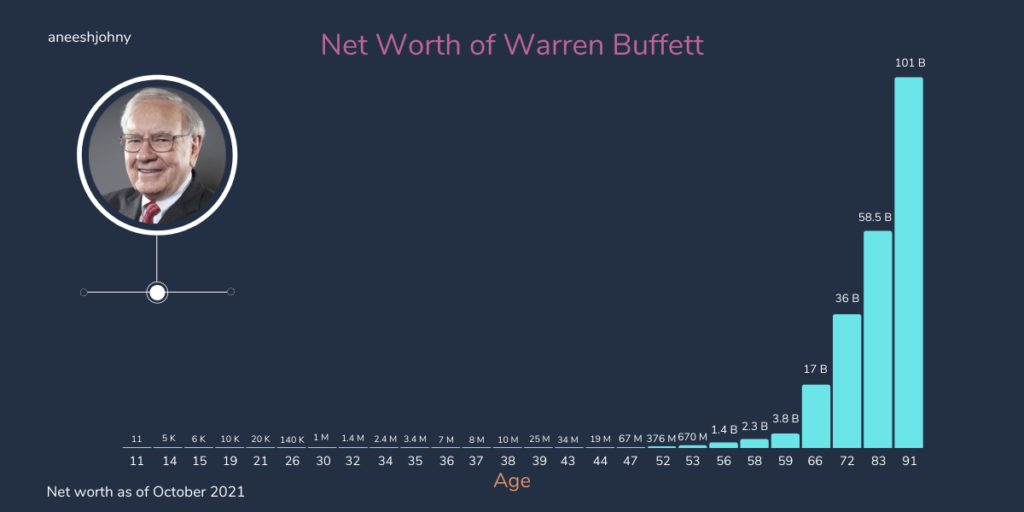

In 1962, Buffett became a millionaire through his assets in partnerships. He merged all of his partnerships into one. He started investing in a textile manufacturing firm called Berkshire Hathaway and eventually took over the company’s control. He then liquidated the company’s physical assets and made an enormous return for partners and shareholders. In 1969, Buffett liquidated his partnerships and transferred the assets, including the shares of Berkshire, to the partners. He lived solely on his salary of $50,000 per year and income from outside investments. Later he started to operate from Berkshire Hathaway as a holding company and started buying and acquiring public and private companies. Buffett became a billionaire in 1990 when the shares of Berkshire Hathaway began to trade more than $7100. And now, Berkshire Hathaway’s stake is priced around $423,000, and his net worth is more than $100 billion. In late 2000 he joined hands with Bill Gates to start his philanthropic activities and donate his Berkshire Hathaway shares to Bill and Melinda Gates Foundation. Even after transferring shares to philanthropic activities, he is still a centi-billionaire.

It took nearly 32 years for Buffett to turn $11 into a million-dollar and another 28 years to become a billionaire. Now he is a centi-billionaire, and it took another 30 years to become one. In the whole process of creating wealth, he increased his wealth by 22-23% yearly. That is an astonishing return considering the benchmark index grew only 9-10% during the same period.

Conclusion

This is not just a story of a boy; and it’s the story of many who followed these same paths and were unknown among others. The main takeaway is that patience and persistence will give you excellent returns no matter what happens in the short term of the investment. Buffett considers buying stokes as buying the company itself. So as people start to investors in the early stages of investing, this is a marvelous example and inspiration. Even if we can make a 10-15% return annually, we can do wonders in our financial life.

You may create money in the short term, but it will take patience and time to make wealth. Be patient, be vigilant, rational, and do your due diligence before picking a stock to invest in.